Nonprofit Tax Preparation

Expert Nonprofit Tax Preparation with Form 990

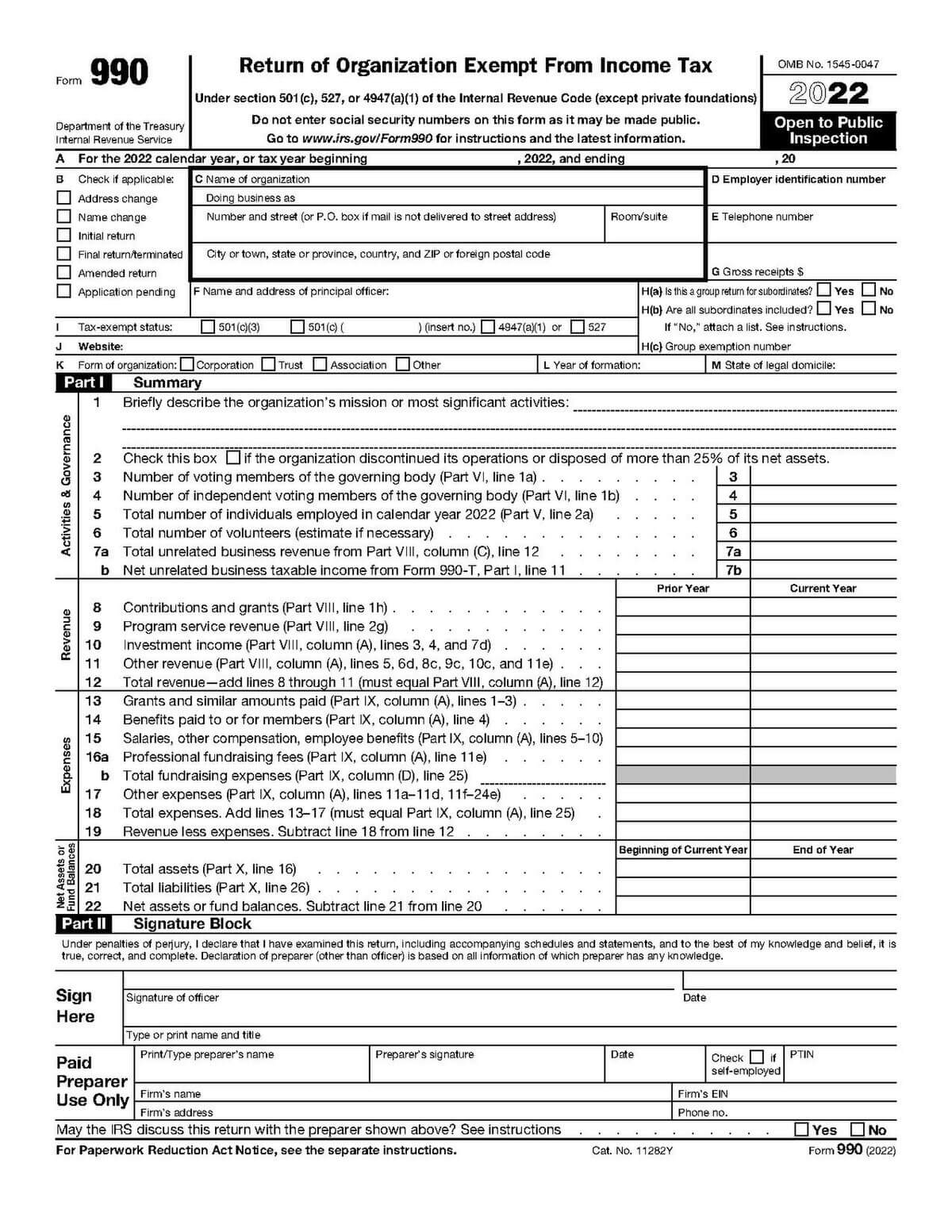

Managing the finances of a nonprofit organization requires a keen understanding of the unique tax compliance requirements that come with it. Nonprofits are typically required to file IRS Form 990, the Return of Organization Exempt From Income Tax. This form demands a deep understanding of nonprofit taxation rules and the ability to convey your organization’s mission effectively through financial data. At Lefstein-Suchoff CPA & Associates, LLC, we specialize in providing expert nonprofit tax preparation services tailored to the distinctive needs of nonprofit organizations. Our team of certified tax professionals is dedicated to ensuring your nonprofit’s tax compliance while optimizing your financial transparency.

Demystifying IRS Form 990: IRS Form 990 is the official tax return for nonprofit organizations, including charities, foundations, and associations. It serves as a comprehensive report of the organization’s income, expenses, activities, and governance practices. Accurate and timely filing of Form 990 is essential for maintaining your nonprofit’s tax-exempt status and building trust with donors and stakeholders.

Our Comprehensive 990 Tax Preparation Process:

- Personalized Consultation: We initiate the process with a personalized consultation to gain insights into your nonprofit’s mission, activities, financial landscape, and any specific circumstances that may affect its tax compliance.

- Data Collection and Presentation: Our experts guide you through the process of collecting and presenting all relevant financial documents, including income statements, balance sheets, program descriptions, and governance information. We ensure your financial data accurately represents your nonprofit’s operations and impact.

- Emphasis on Transparency: Nonprofits are accountable to donors and the public, and transparency is key. We help you present your financial information in a clear, concise, and engaging manner within Form 990, showcasing your organization’s commitment to transparency and stewardship of resources.

- Accurate Preparation: We prepare Form 990 with precision and an unwavering attention to detail. Our tax experts possess in-depth knowledge of nonprofit taxation nuances, ensuring your return is accurately filed and compliant with current tax codes.

- Compliance with Nonprofit Laws: We ensure your nonprofit complies with the specific laws and regulations governing tax-exempt organizations, including disclosure requirements, public reporting, and maintaining tax-exempt status.

- Electronic Filing for Efficiency: For your convenience, we offer electronic filing (e-filing) services, streamlining the submission of your Form 990 to the IRS. E-filing expedites processing and helps maintain your organization’s reputation for timely and accurate reporting.

- Ongoing Support: Our dedication to your nonprofit’s tax compliance doesn’t end with the filing of Form 990. We provide ongoing support, assisting with IRS inquiries, audits, and any necessary amendments to your tax return.

At Lefstein-Suchoff CPA & Associates, LLC, we understand the intricacies of nonprofit tax preparation. Trust our experienced team of tax professionals to handle your nonprofit’s tax compliance needs, allowing you to focus on advancing your organization’s mission. Contact us today to schedule a consultation and ensure your nonprofit remains on the path to financial transparency and impact.