Estate and Trust Tax

Expert Estate and Trust Tax Preparation with Form 1041

Managing the financial affairs of an estate or trust can be a complex task, especially when it comes to tax compliance. Estates and trusts are required to file IRS Form 1041, the U.S. Income Tax Return for Estates and Trusts, which demands a deep understanding of estate and trust taxation rules. At Lefstein-Suchoff CPA & Associates, LLC, we specialize in providing expert estate and trust tax preparation services tailored to the unique needs of your estate or trust. Our team of certified tax professionals is dedicated to ensuring your estate or trust’s tax compliance while optimizing your tax benefits.

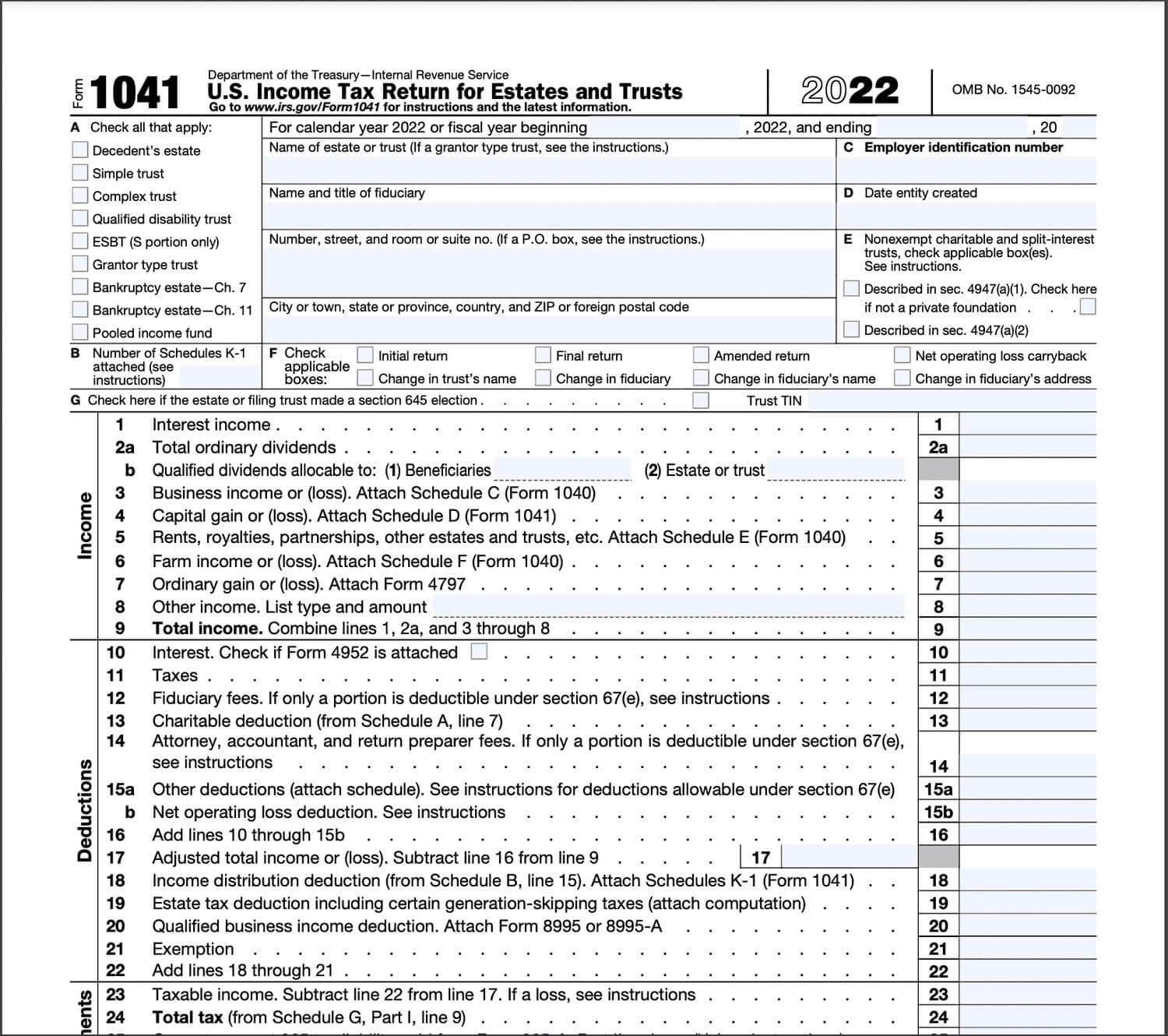

Navigating IRS Form 1041: IRS Form 1041 is the official tax return for estates and trusts, including revocable trusts, irrevocable trusts, and estates of deceased individuals. It serves as a comprehensive report of the entity’s income, deductions, and other crucial tax-related information. Accurate and timely filing of Form 1041 is vital to maintain your estate or trust’s compliance with IRS regulations.

Our Comprehensive 1041 Tax Preparation Process:

- Personalized Consultation: We initiate the process with a personalized consultation to gain insights into the estate or trust’s financial landscape, unique assets, income sources, and any specific circumstances that may impact its tax liability.

- Data Collection and Organization: Our experts guide you through the process of collecting and organizing all relevant financial documents, including income statements, asset inventories, beneficiary details, and supporting schedules. We ensure your financial data is not only complete but also meticulously organized.

- In-Depth Analysis: Our seasoned tax professionals perform a thorough analysis of your estate or trust’s financial data to identify potential deductions, credits, and tax-saving opportunities. Staying updated with the latest tax laws and regulations is our commitment to maximizing your tax advantages.

- Accurate Preparation: We prepare Form 1041 with precision and an unwavering attention to detail. Our tax experts possess in-depth knowledge of estate and trust taxation intricacies, ensuring your return is accurately filed and compliant with current tax codes.

- Beneficiary Distributions: We assist you in navigating the complexities of distributing income and assets to beneficiaries, ensuring proper reporting and compliance with legal requirements.

- Electronic Filing for Efficiency: For your convenience, we offer electronic filing (e-filing) services, streamlining the submission of your Form 1041 to the IRS. E-filing expedites processing and can help you receive any eligible refunds faster.

- Ongoing Support: Our dedication to your estate or trust’s tax compliance doesn’t end with the filing of Form 1041. We provide ongoing support, assisting with IRS inquiries, audits, and any necessary amendments to your tax return.

At Lefstein-Suchoff CPA & Associates, LLC, we understand the complexities of estate and trust tax preparation. Trust our experienced team of tax professionals to handle your estate or trust’s tax compliance needs, allowing you to focus on preserving and growing your assets. Contact us today to schedule a consultation and ensure your estate or trust remains on the path to financial success and tax efficiency.