C-Corporation

Expert C-Corporation Tax Preparation with Form 1120

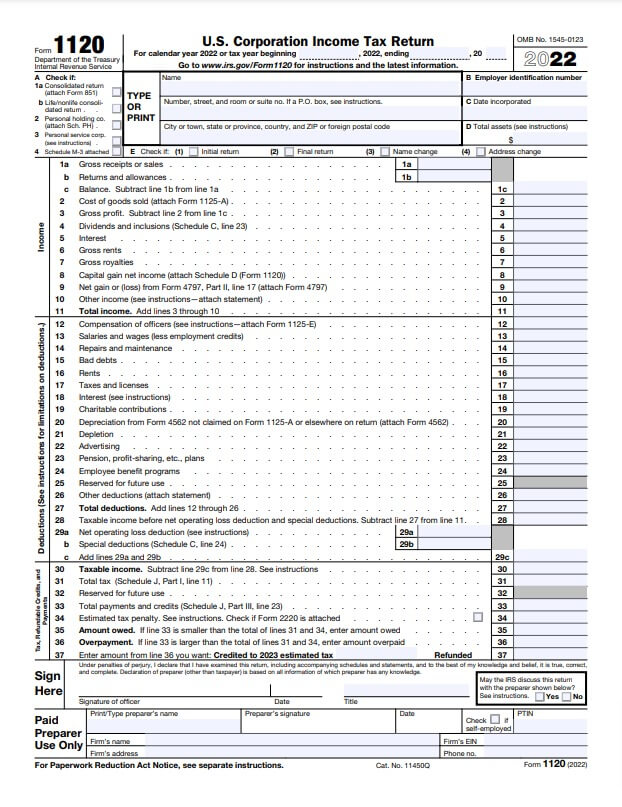

For businesses structured as C-Corporations, tax compliance can be a complex and challenging task. One of the primary responsibilities for C-Corporations is filing IRS Form 1120, the U.S. Corporate Income Tax Return. At Lefstein-Suchoff CPA & Associates, LLC, we specialize in providing expert C-Corporation tax preparation services tailored to the unique needs of your business. Our team of certified tax professionals has the knowledge and experience to navigate the intricacies of Form 1120 and ensure your corporation’s tax compliance.

Understanding IRS Form 1120: IRS Form 1120 is the official tax return for C-Corporations, including domestic corporations, certain foreign corporations, and entities that elect to be taxed as C-Corporations. Filing this form accurately and on time is crucial to avoid penalties and maintain your corporation’s good standing with the IRS.

Our Comprehensive 1120 Tax Preparation Process:

- Initial Consultation: We begin by scheduling a consultation to understand your corporation’s financial situation, industry-specific tax considerations, and any unique circumstances that may affect your tax liability.

- Data Collection: Our team will guide you through the process of collecting and organizing all relevant financial documents, such as income statements, balance sheets, and supporting schedules. We ensure that all financial data is accurate and complete.

- In-Depth Analysis: Our tax experts perform a thorough analysis of your corporation’s financial data to identify potential deductions, credits, and tax-saving opportunities. We stay up-to-date with the latest tax laws and regulations to maximize your tax benefits.

- Accurate Preparation: We prepare Form 1120 with precision and attention to detail. Our professionals are well-versed in the complexities of corporate taxation and are committed to filing your return accurately and in compliance with current tax codes.

- Tax Minimization Strategies: We work closely with you to develop tax minimization strategies that align with your business goals. Our goal is to legally reduce your corporation’s tax liability, optimizing your financial outcomes.

- Electronic Filing: We offer electronic filing (e-filing) services for your convenience, ensuring a seamless and timely submission of your Form 1120 to the IRS. E-filing expedites processing and can help you receive any eligible refunds faster.

- Ongoing Support: Our commitment to your corporation’s tax compliance doesn’t end with the filing of Form 1120. We provide ongoing support, including assistance with IRS inquiries, audits, and any necessary amendments to your tax return.

At Lefstein-Suchoff CPA & Associates, LLC, we take the complexity out of C-Corporation tax preparation. Trust our experienced team of tax professionals to handle your corporation’s tax compliance needs, so you can focus on growing your business. Contact us today to schedule a consultation and ensure your C-Corporation stays on the path to financial success and tax efficiency.